|

|

|

Texas Instruments Incorporated (Inactive Symbol) |

YTD Price Probability |

No random walk data for 2025

|

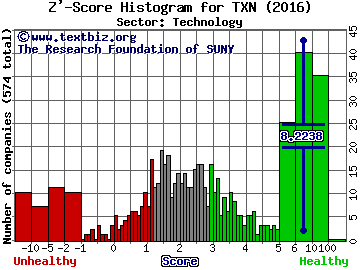

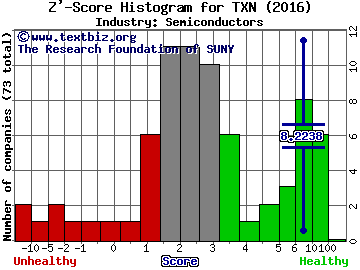

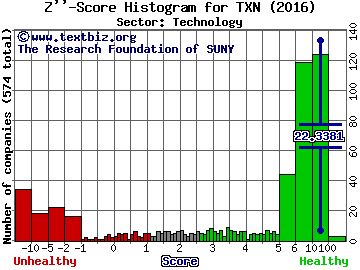

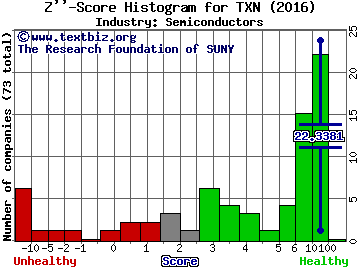

Default Prediction for 2016-12-31 |

Default prediction by Z-Score (what's this?).

View the other companies in the same industry : Semiconductors

Alternative Z-Scores designed for non-public companies (i.e. take these with a grain of salt):

For manufacuring companies:

Sector Industry

|

For non-manufacturing companies:

Sector Industry

|

|

Fundamental Analysis for 2017 |

Fundamental Analysis metrics & ratios (what's this?).

Date of financial statements used: 2017-03-31 |

| Book Value: |

$5.0B |

|

Internal Value: |

$5.0B |

|

Working Capital: |

$5.4B |

| Debt to Asset Ratio: |

0.334 |

|

Current Ratio: |

4.395 |

|

Turnover Ratio: |

7.384 |

| Net Margin: |

29.3% |

|

EPS: |

3.997 |

|

P/E ratio: |

20.188 |

| P/B ratio: |

16.176 |

|

ROE: |

80.1% |

|

ROA: |

25% |

|

|

Company ProfileSymbol: TXN Market Cap: $80.5B Exchange: NASDAQ Sector: Technology Industry: Semiconductors Data Since: 1973-01-02 Website: www.ti.com

[Web Query]

[News Query]

|