|

|

|

Xilinx, Inc. (Inactive Symbol) |

YTD Price Probability |

No random walk data for 2025

|

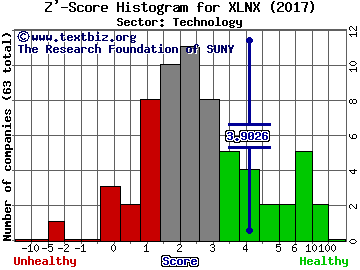

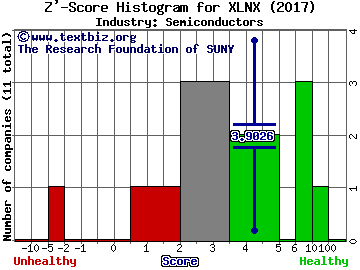

Default Prediction for 2017-04-01 |

Default prediction by Z-Score (what's this?).

View the other companies in the same industry : Semiconductors

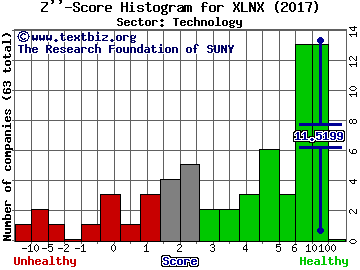

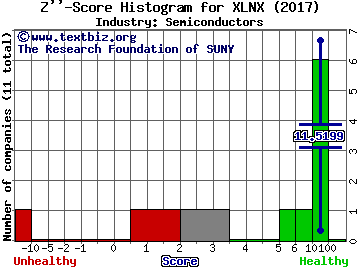

Alternative Z-Scores designed for non-public companies (i.e. take these with a grain of salt):

For manufacuring companies:

Sector Industry

|

For non-manufacturing companies:

Sector Industry

|

|

Fundamental Analysis for 2017 |

Fundamental Analysis metrics & ratios (what's this?).

Date of financial statements used: 2017-04-01 |

| Book Value: |

$2.3B |

|

Internal Value: |

$2.3B |

|

Working Capital: |

$3.0B |

| Debt to Asset Ratio: |

0.471 |

|

Current Ratio: |

4.325 |

|

Turnover Ratio: |

10.348 |

| Net Margin: |

26.5% |

|

EPS: |

2.501 |

|

P/E ratio: |

25.710 |

| P/B ratio: |

6.828 |

|

ROE: |

26.6% |

|

ROA: |

13.1% |

|

|

Company ProfileSymbol: XLNX Market Cap: $16.0B Exchange: NASDAQ Sector: Technology Industry: Semiconductors Data Since: 1991-01-02 Website: www.xilinx.com

[Web Query]

[News Query]

|